Tons of bullish-looking charts out there as well as bullish-looking Thursday reversal candles to play against this week.

LONG SETUPS

Strong Stocks Looking For Continuation

$GOOGL

Keep an eye on the $106 level, and if it doesn’t hold, watch for a potential drop to $104.7ish.

$AMZN

Looking to buy a flush into 50D sma. If it doesn’t, will consider going long if it climbs over $104.20. This could signal the start of the next leg up.

$NET

Look for a potential scoop at the quarterly pivot/20-day moving average. Keep in mind over $64 is the long continuation trigger.

$PYPL

This stock has had back-to-back inside weeks. Consider a scoop off the $73.2ish area with risk under $73 (over $72.97 is the failed weekly short continuation trigger). If the stock climbs over last week’s highs, consider joining the trend.

$WDAY

Consider scooping a flush vs Thursday’s LOD.

$NVDA

Shorts are currently bent on this stock, and a flush to 268 could be a buying opportunity.

Oversold Reversion Setups

$ETSY

Failed breakdown play as long as holds over $103.24. Want to go long over Thursday’s highs.

SHORT SETUPS

Weak Stocks Looking For Continuation

$DOCU

Consider shorting at $58.5 – $59, but be prepared to flip your bias if the stock climbs over $59.7.

$ABNB

Look for a potential shorting opportunity in the $115.5 area.

Overbought Reversion Setups

$ORCL

Look for a shorting opportunity in the $99- $100 area.

$EA

Consider shorting into the $128- $129 range.

$LLY

Keep an eye on the $375 area as a potential shorting opportunity.

Nimble Bias

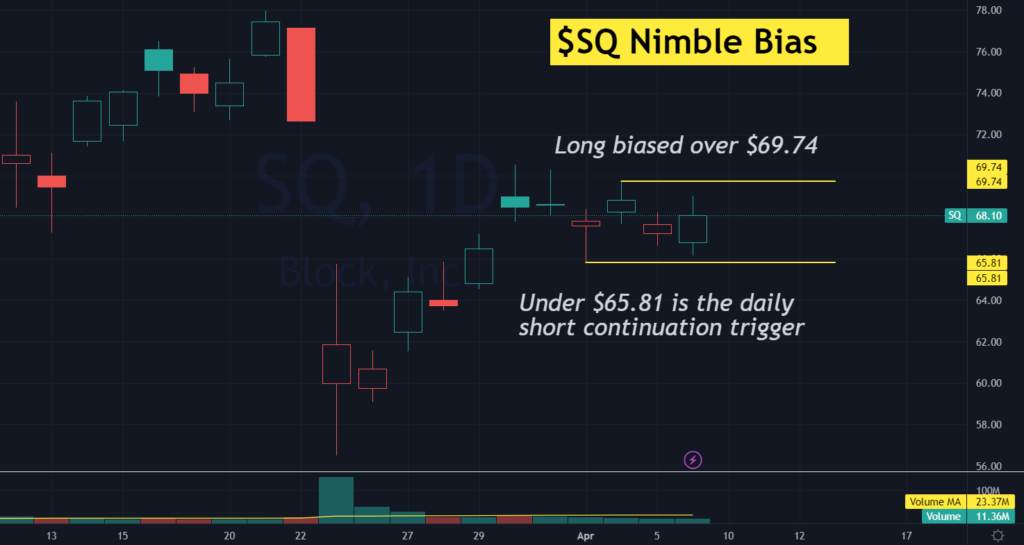

$SQ

With back-to-back inside weeks, you may want to consider going long if the stock climbs over $69.74. However, under $65.81 is the daily short continuation trigger.