Just like was discussed for months on end, just because a bear market may be coming to an end does not mean we go right back into a raging bull market. There is absolutely no reason to think that we don’t possibly chop sideways for months on end, building a strong base to eventually push from, whether that be a push higher or lower. Bases are healthy for markets and allow large moves to digest. Many of the sectors are developing channels. This doesn’t mean much for us, as we are day traders and simply hunting for emotional moves that run out of gas. But if you’re beginning to build long-term swings in some of your long-term accounts, make sure you understand that it is likely no rush to get in and if you jump in now, you will most likely have to weather the psychological toll of seeing your position go well into the green, only to then roll over and go red on you as the market chops around. This is where truly accepting the risk and allowing the trade to “do what it’s gonna do” is vital. The first quarter of 2023 was extremely slow for my system personally, and the beginning of Q2 has been no different. There were only 3 valid trades for me in the first ½ of April! My guess is that the sideways action in the higher timeframes is to blame, but that is just my initial gut feeling. I look forward to this round of earnings as I am hopeful that it will bring back the added volatility to names that we so desperately need for this strat. I feel like a lion crouched in the tall grass as a large herd of prey makes its way down toward the valley where I’m waiting. It’s our job to capitalize when the opportunities present themselves, to wait patiently when there are none, and to know the difference between the two.

DISCLAIMER: No crystal ball to know whether the market gaps up, down, or opens flat. So if a market gap in 1 direction or the other puts individual names close to levels I’m looking to buy/short emotional moves, then those levels will need to be adjusted to account for the gap.

LONG SETUPS

Strong Stocks Looking For Continuation

$AMZN

Over $104.3 can clear the way up to the 200d sma. If prints over that level may look to join the trend on dips. Would also be interested in scooping any emotional flushes into the $99-$100 area.

$COIN

This chart was shared last week in the TrueTrader chatroom and I still think it’s fully valid. Am looking to long any flush vs that LOD from last Wednesday. Currently surfing the 20d and price action is coiling. Always keep in mind that this name has BIG moves when it finally picks a direction. The gap fill is $76.86. If this really gets going, could easily see $85 and higher. Don’t think the bigger targets are day trades, but if you put a day trade on and are able to lock in good profits there is no reason that partial can’t be left on for a swing as long as the stock closes strong and is behaving well. Friday was able to briefly break PDL, so now over Thursday’s highs can light the fuse.

$INTC

Interested in this pullback to the 20d sma after it was finally able to break out of this 6-month channel. Not really a day trade idea since it doesn’t have a ton of range, but still something I want to keep on the radar if it decides to develop a nice uptrend from here.

$GOOGL

Flush to the 20d sma would have me looking to scoop.

$SE

Over $85.31 is the daily long continuation trigger. Will look to join the trend on dips over that level. Alert is set.

$SNOW

Over $144.55 can reverse this pullback into the 20d sma. A good example of a name where part of the day trade may be held for a swing trade.

Oversold Reversion Setups

Nothing notable

SHORT SETUPS

Weak Stocks Looking For Continuation

$QCOM

Looking for an emotional pop back into the $125 area to fade.

$ABNB

A hard spike into the underside of the 20d is the first spot I would look to short. If it wants higher, no problem stopping out and revisiting the $120 area.

$BBY

Not a fan of the liquidity on this name, but looks like it’s hanging on by a thread here. Under Thursday’s LOD and could be a “join trend on pops” candidate. The other way I might consider participating would be shorting an emotional pop into Friday’s HOD/underside of the 20d sma.

Overbought Reversion Setups

Nothing notable

Nimble Bias

$TSLA

Two inside days, looming failed weekly short continuation trigger, earnings Wednesday

after hours. As for any day trades prior to earnings, just watching to see if we break above Thursday’s highs or below Thursday’s lows. Whichever way it picks, I will look to trade it directionally for the day. So over Thursday’s highs, I will look to join the trend on any flush back into support (and vice versa below Thursday’s lows). Over $191.6 and the ability to hold over the 50d will possibly give way to another leg higher towards $208. But I highly doubt the bigger picture move unfolds until after the earnings are released.

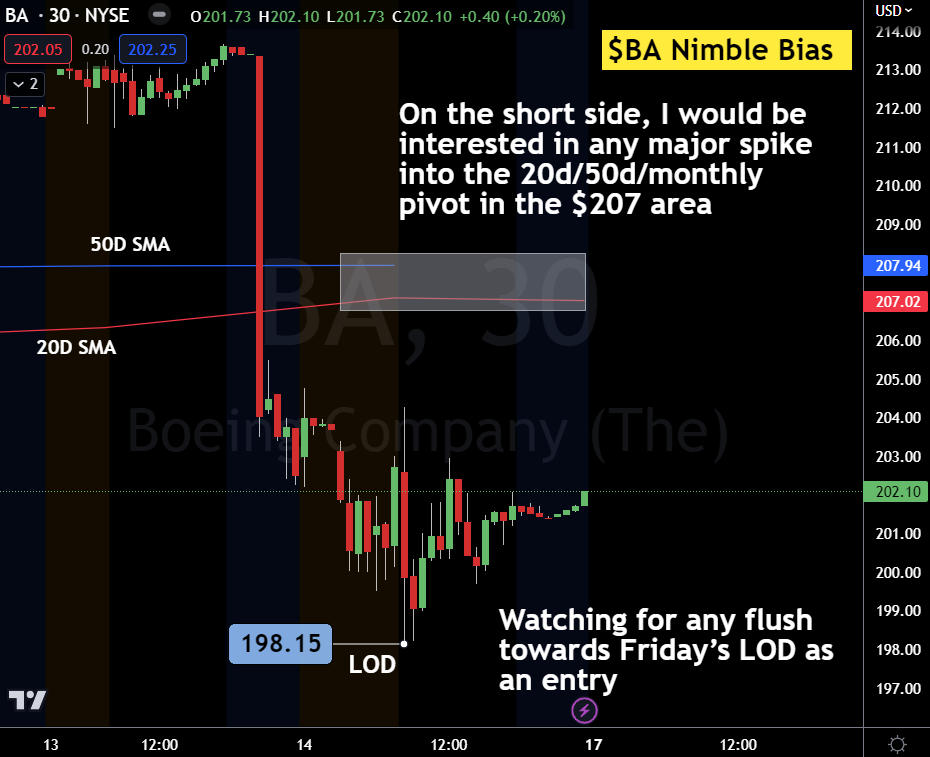

$BA

Watching for any flush toward Friday’s LOD as an entry. You have the monthly pivot down there as well as the trendline from the 3/15 and 3/24 lows. On the short side, I would be interested in any major spike into the 20d/50d/monthly pivot in the $207 area.

$ROKU

Inside week. This was looking really bullish just a few weeks ago, but it had that major fail after attempting to push on 4/4. We’ve tightened back up and I think a break above or below last week’s high or low will give us some direction. Alerts set and will look to join the trend, whichever way the author chooses.