The stock market is a dynamic and constantly changing landscape, and as a trader, it’s important to stay informed about the various factors that can impact the performance of individual stocks and the market as a whole. One important concept to understand is the idea of “sympathy pairs” in stock trading.

What is a sympathy pair?

A sympathy pair refers to two stocks that tend to move in the same direction, often because they are closely related in some way. This could be because they are in the same industry or sector, they are direct competitors, or they are affected by similar macroeconomic factors. Understanding and identifying sympathy pairs can be a valuable tool for traders, as it can help them make more informed decisions about when to buy or sell a particular stock.

Strategies for finding sympathy pairs in stocks

Identifying Competitors to find sympathy pairs

One strategy for finding sympathy pairs is to focus on individual stocks and their competitors. For example, if you’re interested in buying shares of a particular company, it can be helpful to also research and keep an eye on its main competitors. If the competitor’s stock is performing well, it’s likely that the stock of the company you’re interested in will also perform well. This is because the performance of companies in the same industry or sector is often closely tied together.

Using Releases and Announcements to find sympathy pairs

Another strategy is to pay attention to product releases and announcements. Companies in the same industry or sector often release new products or announce important news at similar times, so keeping an eye on these events can help you identify potential sympathy pairs. For example, if a new iPhone is released, it’s likely that the stock of Apple will perform well, but it may also be a good time to buy shares of companies that supply components for the iPhone, such as those in the semiconductor industry. Identifying publicly traded companies that are affected by major brands such as Apple is part of the work every serious trader must do. This article by Investopedia does a great job explaining Apple’s supply chain suppliers and their role in the Apple ecosystem.

Using Sectors to find sympathy pairs

Sectors are also a great way to identify sympathy pairs. For example, if a company is in the technology sector, its stock may be closely tied to the performance of other companies in the technology sector. Paying attention to the performance of the sector as a whole can help you identify stocks that may be good sympathy pairs.

The importance of macroeconomic factors to find sympathy pairs

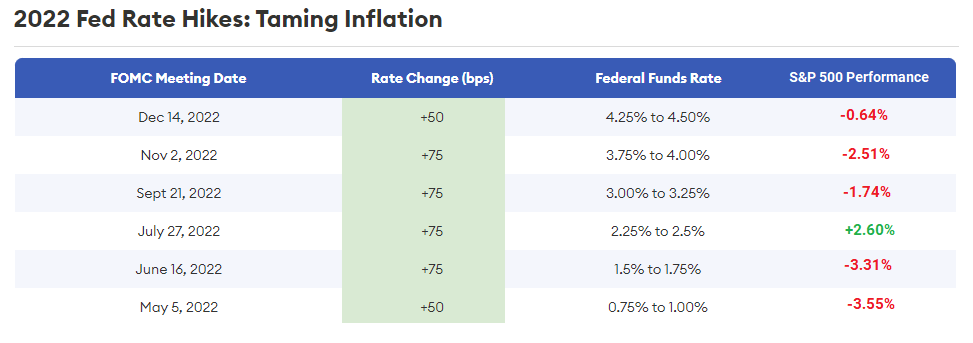

In addition to these strategies, it’s also important to keep an eye on macroeconomic factors that can impact the stock market as a whole. For example, changes in interest rates or economic growth can have a significant impact on the performance of stocks, so understanding these factors and how they may impact different industries or sectors can help you identify potential sympathy pairs.

In conclusion, sympathy pairs can be a valuable tool for traders looking to make informed decisions about buying and selling stocks. By focusing on individual stocks and their competitors, paying attention to product releases and announcements, and keeping an eye on macroeconomic factors, traders can identify potential sympathy pairs and potentially increase their chances of success in the stock market.