Whether you are a professional day trader or a novice looking to enhance your performance, access to the best trading platforms can be the key to your success. The best day trading platforms provide fast and efficient execution. The top two online day trading brokers will allow you to trade through electronic exchanges around the globe 24 hours a day. Whether you want to trade equities, options, futures, or structure products, the best day trading platforms can integrate your trading activity under one financial umbrella.

To generate robust day trading returns, you want to have access to day trading buying power which is an enhanced leverage available specifically for day traders. Before you deposit your funds with a new broker, make sure you are eligible for day trade buying leverage.

Additionally, the best day trading platforms allow you to monitor your risk and balances at the portfolio level. You should be able to see your combined positions on one balance sheet as well as separate them by account.

What is Day Trading?

Day trading means that you plan to enter and exit a trading position within the same day. You do not plan to hold positions overnight, and therefore your risk is limited to an intra-day change in the price of financial securities. Day trading strategies tend to take advantage of sharp movements in the price of financial assets, that can be enhanced with leverage that is tailored to a day trader.

What is Day Trading Buying Power?

If you plan to day trade, your broker can provide you with leverage using a margin account. A margin account is a trading account that allows you to use borrowed capital to enhance your trading returns. A margin account allows you to use only a fraction of the capital you need to purchase and sell short securities. For example, if you have financial leverage of 2x, you will only need to post collateral of $50 to control $100 worth of stock.

If you have a margin account you might be able to qualify for Day Trading Buying Power (DTBP). This is a variable that determines the capital that is available to place trades on an individual day. Day Trading Buying Power is equal to 4x your excess maintenance margin. Your excess maintenance margin is capital in your trading account that is currently not used as collateral for securities that you have purchased or sold.

Day Trading Buying Power Rules

To qualify for day trading buying power you need to have:

- More than $25,000 in your account.

- The account needs to be classified as a Pattern Day Trading account.

- Your buying power is capped at the value at the beginning of the trading session.

Your broker will consider you a pattern day trader if you transacted more than 4-day trades within 5 trading days. A day trade is defined as a buy and a sell of the same security where your risk increases and then decreases during the same trading session. A partial trade will also qualify for a day trade. For example, if you purchase 100 shares and sell 25 of them during the same session.

The best brokers will provide consistent day trading buying power and update you constantly on your available capital. If your account drops below the $25,000 threshold, your broker could temporarily suspend your account if you transact more than 3 day trades within 5 trading days.

How Do You Choose a Day Trading Platform?

If you plan to day trade, you need to consider whether a platform will provide you with the tools you need to be successful. If you plan to trade at home or in an office, the best trading platforms are downloadable and reside on your laptop’s hard drive. If you plan to be on the go, you need to make sure you have access to a mobile trading platform. If you are looking for a commission-free platform it will most likely be accessed through your browser as well as a mobile application. Opening an account should be free and many require no-minimum account size.

The Top 4 Trading Platforms

The best trading platforms provide fast and efficient execution as well as several bells and whistles including research, charting software, and flexibility. You can easily contact the best brokers through chat, email, or on the phone. If you are looking for the best day trading platform for trading like a pro, check out Interactive Brokers Pro and Charles Schwab StreetSmart Pro.

1. Interactive Brokers

Interactive Brokers® IBKR Pro is one of the best trading platforms. It provides investors with a slew of trading tools. The Pro application allows you to trade on any electronic exchange globally while watching Bloomberg TV. They offer trade execution for stocks, options, and futures around the clock.

To compete with the ever-changing landscape for lost-cost investing, Interactive Brokers® developed a Lite pricing plan in October 2019. This plan offers no-commission trades on most of the IB platforms, but lacks a lot of essential tools needed for effective day trading.

Interactive Brokers offers a browser-based platform, a mobile platform, and a Pro platform which needs to be downloaded to your hard drive. They require two-factor authentication, which means that each time you log on to your account you will need to have access to your cell phone.

The Dashboard

The Pro version of the IBKR allows you to navigate easily. You can opt to keep your navigation window open or closed. The risk navigator is an excellent feature that allows options traders to combine the risk of the options positions in conjunction with their stock or futures positions. You can see aggregate positions and P&L or individual accounts.

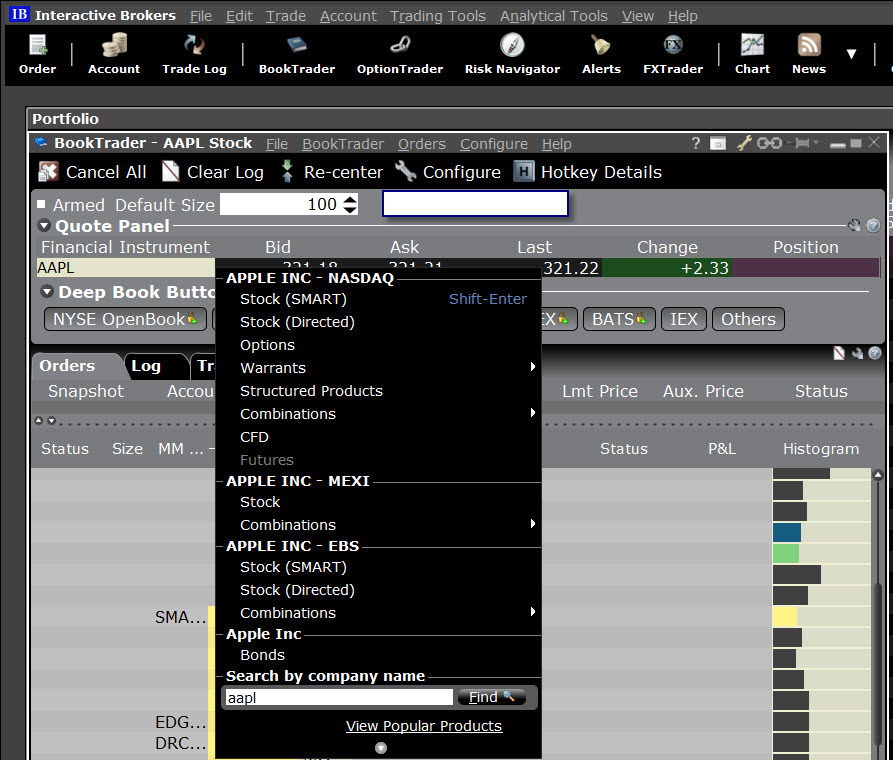

The Booktrader

The Book Trader is the equity transaction module that allows you to self-direct to a specific exchange or use the smart-transaction facility which finds the best bid and offer. You can search by company name or the ticker to find an asset. When you pull up a stock, like Apple, you have the option of trading several products including stocks, bonds, options, warrants, as well as structured products. This will depend on your account setup and the assets that you are allowed to transact. If you have a futures account, or a CFD account you can link these accounts together.

The Option Trader is the best in the business. The dashboard allows you to have more than 100 open tabs that short-cut to an options execution screen. Every option-related metric is available. Execution of individual options spreads (including straddles, strangles, vertical spreads, and calendar spreads) and combinations are easily transacted.

Charting Capabilities

IBKR allows you to chart any assets that you can transact. The charting software allows you to search for an asset just like the Book Trader. You can choose your time horizon, the type of graph you want to see (line, bar, candle), as well as specific data points such as the bid or ask. You can even chart historical option premiums or option-implied volatility.

The IBKR mobile platform is a basic platform that can keep you abreast of market changes as well as allow you to transact, see your positions and balances as well as deposit and withdraw assets. If you plan to day trade, this platform is more of an auxiliary platform than a platform that you would use to drive your day trading activities.

2. Charles Schwab Trading Platform

Charles Schwab is a heavy-hitter in the asset management game with more than 3.85-trillion under management. Charles Schwab is one of the largest online trading brokers and provides one of the best trading platforms. The company has more than 1,200 financial advisors and owns an FDIC-insured bank. As of 2020, Charles Schwab has more than 12.1 million active trading accounts.

Charles Schwab offers zero-commissions on some of its platforms. Their StreetSmart Edge platform is their best day trading platform and provides robust execution for several different asset classes including stocks, options, bonds, futures, and structure products.

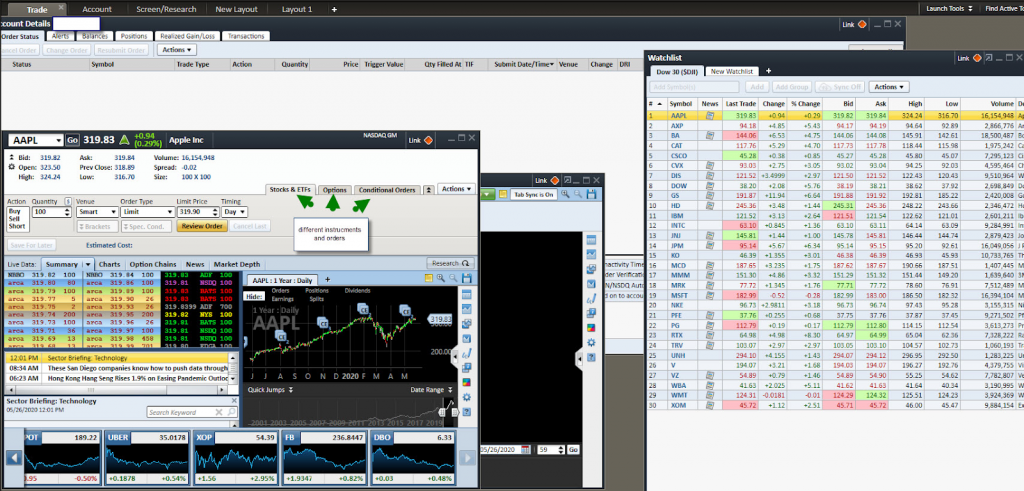

Dashboard

The Charles Schwab StreetSmart Edge® dashboard is very flexible which is one of the reasons it’s considered one of the best trading platforms. You can customize the windows to include the execution module, which allows you to directly access an electronic market or use “smart” to find the best bid and offer. You can even watch CNBC while you’re trading. You can create dozens of layouts that are easy to navigate. You have the option to expand your dashboard with the “launch tools” menu, which gives you access to research, charting, execution, as well as several different third-party tools.

Charting

There are multiple tabs that quickly allow you to switch from equity trading to options trading. The charts are multi-functional charts that allow you to add basic as well as sophisticated studies. You can generate a chart directly from the execution window on stock prices as well as option prices. It also provides historical implied volatility of charting capabilities.

One of the benefits of using StreetSmart Edge® is that you can navigate easily between accounts. This makes day trading multiple accounts very efficient. This will allow you to quickly send money from one account to another which can be helpful if you want to increase the day trade buying power the next day.

Charles Schab also offers a browser-based platform and a mobile platform. The browser-based platform has a good execution module, as well as solid charting capabilities. These tools are not as good as the options on the downloadable StreetSmart Edge platform. The browser-based platform is one of the best trading platforms for research.

You can search for any public company, and find research from Charles Schwab as well as several independent parties including Credit Suisse, Morningstar, Ned Davis, and Argus. The amount of research available is what sets Charles Schwab apart as one of the best day trading brokers.

3. Thinkorswim®

Thinkorswim® is TD Ameritrade’s award-winning platform that is geared to the professional investor. The company offers quality trading platforms, with $0 commissions on online stock, options, and ETF trades and a large selection of mutual funds (there is an additional clearing house charge of $0.65 per option contract).

The platform offers a range of premium features including real-time data streaming, more than 400 technical analysis tools, and advanced charting as well as free benzinga squawk access. The breadth of options can make thinkorswim® somewhat complicated for novice traders. In November of 2019, Charles Schwab announced the acquisition of TD Ameritrade. The deal is expected to close at the end of 2020. Until that period, thinkorswim®® will be accepting new accounts, which will be moved to Charles Schwab when the purchase is finalized.

Tradeable Securities

TD Ameritrade provides a wide variety of tradeable securities which sets them apart. On the thinkorswim® platform, you can trade stocks, stock options, ETFs, futures contracts, options on futures forex, and bitcoin futures trading for approved clients. For the less active client, thinkorswim® offers over 11,000 mutual funds on its platform with expense ratios of 0.50% or less.

Virtual Trading Platform

Thinkorswim® is one of the few online brokers to offer a demonstration trading account on its platforms. A demonstration account allows you to practice using real-time data in conjunction with the platform features to test-drive your strategies. You don’t have to worry about making a mistake or losing real-capital. The paperMoney® virtual simulator is a desktop-based platform geared toward advanced traders. It provides $100,000 in demo-funds and is available for free through the thinkorswim® trading platform.

Additionally, with OnDemand features, you can backtest trading strategies, evaluate your skills, and refine your trading approach without worrying about risk.

The Dashboard and Charting

The thinkorswim® dashboard easily allows you to switch between monitoring positions to charting, to executing trades. The charting facility provides more than 400-different studies, including momentum, mean reversion, and trend following analysis. You can easily draw trend lines, channels, and Fibonacci retracements to help you determine the future direction of an asset.

Trading Platforms

In addition to the thinkorswim® desktop platform that has a corresponding mobile application, TDAmeritrade offers a browser-based on-ramp platform that offers everything an average investor would need. This includes research from Morningstar, Thomson Reuters, and TD Ameritrade. You can use the GainsKeeper® tool to track gains and losses to manage your taxes. The Portfolio Planner tool is great for asset allocation adjustments.

Commissions and Fees

There is no charge or minimum deposit when opening an account. Thinkorswim® charges zero commissions on online stock, ETF, and zero commissions on options trades, but a $0.65 per trade clearing fee.

Thinkorswim® is an excellent platform geared to advanced traders. The platform-tools are sophisticated, yet easy to access. The number of tradeable assets provides advanced traders with several different options. Thinkorswim® is one of the few online brokers that provides a demonstration account which allows you to test-drive your trading strategies without risking real capital. They offer a desktop version as well as a mobile app, which is nearly as advanced as the downloadable trading application.

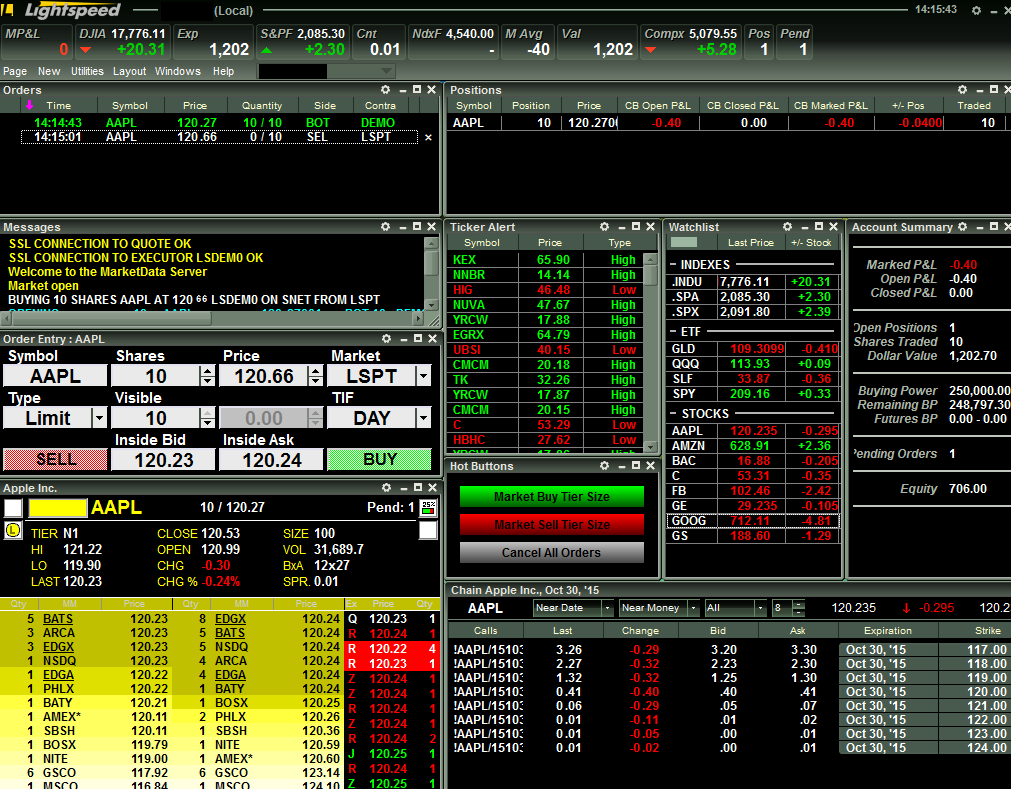

4. Lightspeed™

Lightspeed™ is a desktop-based downloadable trading platform designed for speed of execution. The platform includes endless hotkey options for trading quickly and efficiently. There are three different platforms, including Trader, Web Trader, and Sterling Trader. The main platform Lightspeed™ is geared to the professional trader offering robust technical analysis tools, as well as excellent charting capabilities. For the novice trader, Lightspeed™ offers a web-based product that does not have the same functionality as the desktop version. They also have a mobile app that does not connect to Lightspeed Trader and provides basic functionality.

Tradeable Instruments

Lightspeed™ offers active traders a full range of tradable securities including stocks and options. To enhance the speed of your trade, the platform provides numerous routing venues, as well as a plethora of order types, and complex options trades. Novice investors will not find access to fixed-income securities such as bonds, mutual funds, or any commission-free ETFs.

Dashboard and Charting

Lightspeed™ is a sophisticated trading platform that allows traders to efficiently move from monitoring positions to executing trades. It has robust charting software that allows you to zoom in on specific areas to determine how that compares to a broader range of prices. There are hundreds of built-in technical analysis tools that can be used to help you determine the future direction of the price of an asset.

With Lightspeed, you can use a variety of additional charting platforms, like Sterling Trader, Eze, EMS, and various others

Fees and Commissions

The commissions and fees are geared to the professional investor. There is a minimum deposit of $10,000 to open an account. Stock and ETF trades are $4.50. There is no base for trading options and $0.60 per contract for clearing. Broker assisted trades are $25.

Lightspeed™ has a two-tiered commission structure. They offer a per-share or per-trade fee. The more volume you trade and the higher the frequency, the lower the rate. Per-share, trading starts at $0.0045 per share plus/minus routing fees of $1. Per trade starts at $4.50 plus/minus routing fees.

Lightspeed™ also charts a platform fee. The software fee is $130 per month minus commissions. So if you spend less than $130 per month in commissions you will incur a software fee.

The Bottom Line

You will likely find there are specific features that attract you to a day trading platform. Whether it is research, charting, or your ability to execute several different financial assets, the best day trading platforms for beginners (as well as experts) are the Interactive Brokers® Pro platform, Charles Schwab StreetSmart Edge®, thinkorswim® and Lightspeed™. As a day trader, you might have access to Day Trade Buying Power, which is the leverage that can enhance your returns.

These four platforms have bells and whistles that set them apart. IBKR focuses on providing traders access to electronic markets around the globe. Whether you are trading futures, equities, or options, IBKR has the execution module that is second to none. Charles Schwab is one of the largest asset managers in the world and offers access to a plethora of third party research which makes this one of the best day trading platforms available. Thinkorswim® focuses on its studies and analysis that can be tested with their demo account, and Lightspeed™ focuses on optimizing execution.

The True Trader strategy works with any trading platform on the market. However, we recommend that beginner traders start with a Thinkorswim account and use the paper money system to get a feel for our strategy and workflow. We have masterclasses dedicated to the Thinkorswim and Lightspeed platforms, so you can quickly learn some of the most powerful trading platforms available.

Sign up today and start your journey of becoming a successful day trader.